Frost Pllc Fundamentals Explained

Frost Pllc Fundamentals Explained

Blog Article

Things about Frost Pllc

Table of ContentsNot known Details About Frost Pllc 7 Simple Techniques For Frost PllcSee This Report about Frost PllcFascination About Frost Pllc

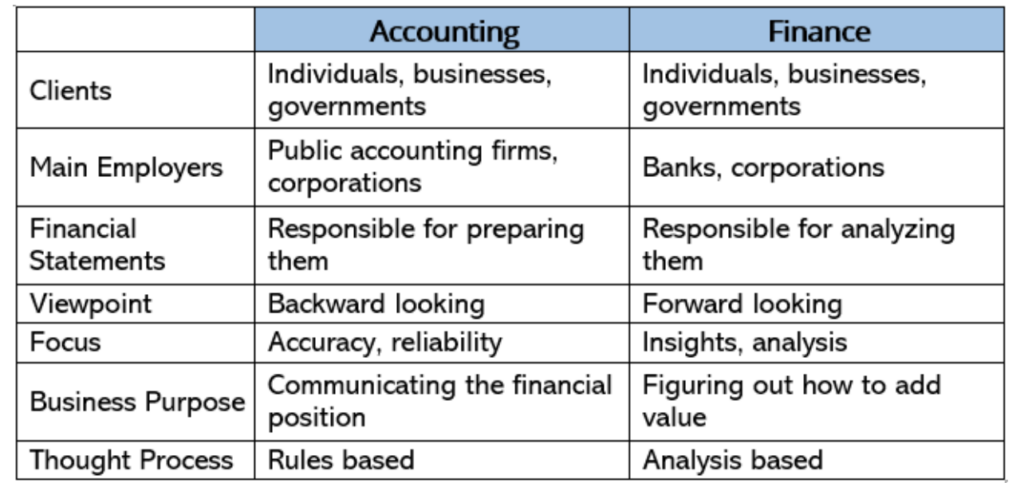

When it comes to financial solutions, there are several various types of firms readily available to pick from. Two of the most common are accounting companies and CPA companies. While they might appear similar on the surface, there are some key distinctions in between both that can influence the kind of solutions they use and the qualifications of their personnel.Among the crucial distinctions in between bookkeeping companies and certified public accountant companies is the certifications required for their personnel. While both kinds of companies might employ accountants and various other monetary professionals, the second one require that their team hold a certified public accountant license which is provided by the state board of book-keeping and needs passing a strenuous test, conference education, and experience demands, and sticking to strict moral standards.

While some may hold a bachelor's degree in accountancy, others may have just completed some coursework in accounting or have no official education and learning in the field in any way. Both accounting firms and CPA firms supply a range of monetary solutions, such as bookkeeping, tax obligation prep work, and economic planning. Nonetheless, there are significant differences between the services they provide.

These policies may consist of demands for proceeding education, honest criteria, and high quality control procedures. Accounting companies, on the other hand, might not undergo the same degree of regulation. They might still be needed to adhere to specific standards, such as generally approved accounting principles (GAAP) or worldwide financial reporting criteria (IFRS).

An Unbiased View of Frost Pllc

These services might include tax planning, audit solutions, forensic accountancy, and strategic data-driven evaluation (Frost PLLC). The range of services offered by CPA firms can vary significantly relying on their dimension and focus. Some may specialize only in audit and guarantee solutions, while others might provide a larger range of solutions such as tax obligation preparation, enterprise threat monitoring, and consulting

Certified public accountant firms might specialize in serving specific sectors, such as health care, finance, or real estate, and tailor their solutions accordingly to satisfy the unique requirements of clients in these markets. There are differences in the charge frameworks of bookkeeping firms and CPA companies. Accounting firms may charge per hour prices for their services, or they might offer flat charges for specific tasks, such as accounting or economic statement preparation.

Senior Manager and CPA with over 20 years of experience in bookkeeping and monetary services, specializing in threat monitoring and regulatory compliance. Knowledgeable in taking care Visit Website of audits and leading groups to supply remarkable services. The Difference Between a CPA Firm and an Accounting Firm.

Getting The Frost Pllc To Work

Several bookkeeping company leaders have actually established that the traditional collaboration model is not the way of the future. At the same time, financier interest in expert services firms is at an all-time high.

All attest solutions are executed only by the CPA firm and supervised by its owners. The certified public accountant company and the services company enter into a services contract, according to which the solutions business might offer expert team, workplace area, equipment, technology, and back-office functions such as invoicing and collections. The certified public accountant company pays the solutions company a fee for the solutions.

The adhering to are a few of the vital factors to consider for certified public accountant firms and investors contemplating the formation of an alternate method structure. Certified public accountant firm possession requirements are made partly to insulate prove services and associated judgments from market stress. That means a CPA company supplying confirm services have to remain a separate legal entity from the lined up solutions business, with distinct controling documents and administration structures.

The bottom line is that events to an alternate method structure have to meticulously check out the suitable self-reliance programs and implement controls to check the CPA firm's freedom - Frost PLLC. A lot of different method structure purchases involve my latest blog post the transfer of nonattest involvements and associated files. Events should take into consideration whether client consent is called for and ideal notice also when consent is not required

3 Simple Techniques For Frost Pllc

Typically, any kind of form of retirement arrangement existing at the CPA company is ended about the transaction, while puts and calls may be appropriate to companion had equity in the solutions firm. Connected to the financial considerations, CPA companies require to take into consideration exactly how the next generation of firm accounting professionals will certainly be rewarded as they achieve standing that would typically be accompanied by partnership.

Both investors and certified public accountant companies will need to stabilize the competing passions of staying clear of dilution while appropriately incentivizing future company leaders. Financiers and CPA firms require to deal with post-closing administration matters in the solutions business. A financier thinking about a control financial investment (and connected governance) in the solutions business ought to take into consideration the increased reach of the auditor self-reliance guidelines in that situation as contrasted to a minority financial investment.

Report this page